Trade finance digitization turns trade finance assets like invoices and order books into smart contracts that give every partner in the value chain up and downstream visibility.

Trade finance digitization makes it easier to monetize these self-financing contracts for asset managers, banks, and other players in the trade finance ecosystem.

As an asset class, trade finance represents a massive opportunity, and one that creates growth avenues for finance firms that haven’t accessed this market.

One reason for this hesitancy is some of the myths surrounding the market, like:

1. Trade finance is expensive;

2. It requires an all-or-nothing approach;

3. It’s high-risk;

4. This trade war will destroy trade finance;

5. You need a technical team for trade finance.

In this article, we explore these myths and do our best to debunk them, to show you the truth around trade finance digitization.

What is Trade Finance Digitization?

Trade finance digitization is the the process of turning trade finance assets ⏤ purchase orders, invoices, letters of credit (LoC), insurance policies, etc. ⏤ into self-executing smart contracts that are used to optimize the working capital lifecycle.

Trade finance is a high-growth market. 80 to 90% of world trade relies on trade finance which is currently worth $9.7 trillion, with a CAGR of 3.1%.

In largely untapped markets ⏤ Africa, Asia, China, India, and the United Arab Emirates (UAE) ⏤ there’s an opportunity worth $2.5 trillion, according to the International Asian Development Bank.

There is no universal language for trade finance, despite attempts by the International Chamber of Commerce (ICC) to create standard definitions.

As a result, all of these terms and programs fall under the ‘trade finance’ concept:

- Working capital monetization

- Supply Chain Finance (SCF)

- Accounts Receivable (AR)

- Invoice Factoring (IF)

- Pre and Post-Shipment Financing

- Distributor Financing

- Reverse factoring

Each and every one of these aspects of trade finance would benefit from digitization. The process, outcomes, and advantages of digitization are the same, whether we are talking about SCF or IF.

However, for every participant in the value chain to feel the benefits, your organization needs to be working with a platform-agnostic technology solution, like LiquidX.

For example, say you’ve digitized $50 million worth of invoices, you need to be confident that every team in the value chain can access those digital smart contracts, rather than needing to revert to physical photocopies.

With LiquidX, you can do that, and so much more without increasing headcount or having in-house software built to perform this function.

Because there are too many myths and misconceptions surrounding trade finance, we are going to debunk the top 5 in this article.

5 Myths of Trade Finance Digitization Busted

Here are 5 trading finance myths broken down and debunked.

- Trade Finance Digitization Will Increase Headcount

It kind of makes sense: If you are expanding your trade finance function or just getting into trade finance, that you’re going to need more staff, right?

Fortunately, banks and asset managers don’t need to increase headcount to benefit from this high-growth asset class.

With the right end-to-end digitization, monetization, monitoring, and management software, you won’t need to increase headcount.

Everything can be managed using LiquidX ⏤ which is supported by Broadridge Financial Solutions ⏤ and your headcount can stay the same. This means tapping into new revenue streams and growth opportunities without additional overheads.

- Digitization of Trade Finance Requires Digital Transformation

Traditionally, the logistics of trade finance consists of physical contracts and spreadsheets. One reason for this is that trade finance is a complex, multi-player environment, consisting of:

- Importers and exporters

- Shipping companies

- Trade finance providers

- Banks

- Asset managers

- Insurers and re-insurers

- Corporate treasury departments

- Export credit agencies and third-party service providers

Perhaps as a result, trade finance has been slow to adapt and go digital.

Hence why banks, asset managers, and corporate treasury departments can be hesitant to implement trade finance programs.

One worry is, will we need a full-scale (and expensive) digital transformation?

The answer is no, complete digital transformation isn’t essential. It’s possible to use digital tools and physical documents without needing to overhaul everything.

It’s also not necessary to try and force companies you work with to change how they do things.

With trade finance software solutions that automatically digitizes assets in the front office, all of this is taken care of without the need for an all-or-nothing digital transformation.

- Trade Finance is a Risky Asset Class

For banks and asset managers that aren’t already in the trade finance market, there’s a sense that it’s a risky asset class.

The good news is that this couldn’t be further from the truth.

Basel III Endgame rules are coming into force soon (July 1, 2025, with a 3-year phase in period), intending to further de-risk the financial sector. The aim is that the world will never again experience what we went through during the financial crisis of 2007–2008.

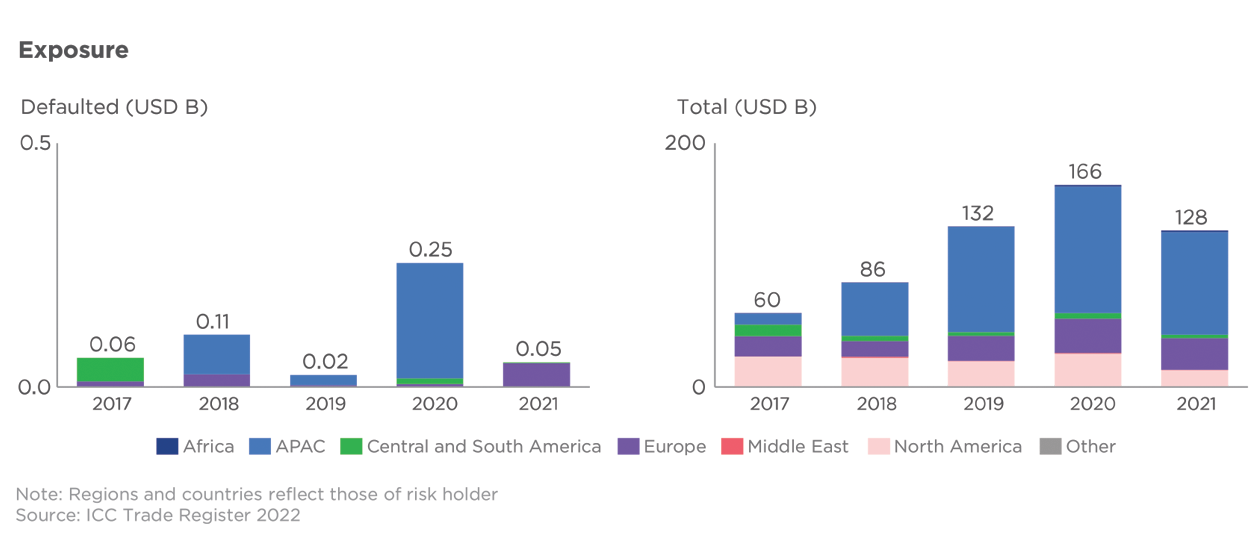

When it comes to trade finance, the Basel III rules were purposefully watered down because trade finance is a low-risk financial product, with much lower default rates than other lending instruments (see below).

As the IMF noted in a policy paper about Basel III in 2014: “As a low-risk, highly collateralized assets, traditional forms of trade finance, such as letters of credit and other self-liquidating commitments to pay with a very small loss record, are clearly not the target of the re-regulation exercise.”

Chart 1: Low default rates for trade finance products

Low risk and very low default rates for accounts receivable (AR) and supply chain finance (SCF) (source)

Trade finance products like SCF, and AR are low risk for the following reasons:

- They are self-collateralized;

- Short-term (contracts are usually < 12 months);

- Can be insured;

- Have lower default rates;

- Are self-liquidating.

The data shows that trade finance is not a high-risk financial asset. Quite the opposite.

- Trade Wars Will Destroy Trade Finance

We can’t ignore the elephant in the room. Begun, the trade wars have.

On Tuesday, 4 March 2025, U.S. tariffs on China, Canada, and Mexico went into effect, resulting in immediate retaliatory tariffs sparking a trade war between the U.S., China, Canada, and Mexico.

Unlike last time, these and other countries and major economic regions are prepared for President Trump’s tariff packages. Canada reacted almost immediately, placing a “25% levy on more than $20 billion worth of U.S. products.”

Consumer confidence has been shaken, with “CEOs of big retailers, including Target and Best Buy, warned an impending trade war will likely raise prices.”

The impact on stock markets has been almost as bad. Every major U.S. market was down on Tuesday: Dow Jones: -1.6%; S&P 500: -1.2%; Nasdaq: -0.4%.

Markets in Europe and Asia were also down. The world is holding its breath, waiting to see how disastrous this trade war could get.

Naturally, this has the $9.7 trillion trade finance sector wondering: How will these proposed tariffs affect us?

As bad as these immediate shocks have been, and the uncertainty amongst investors, businesses and consumers, we do have more reassuring data to work with.

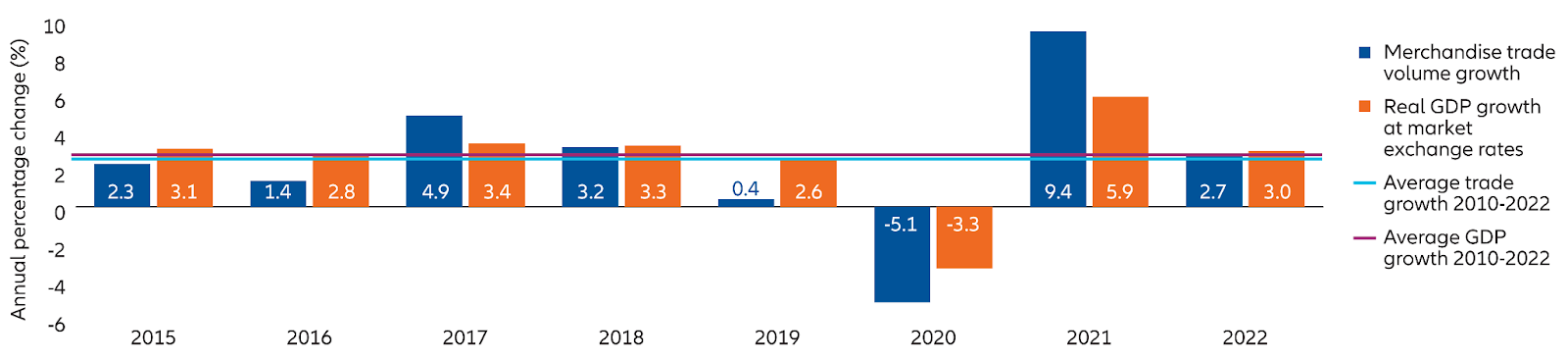

During Trump’s first term (2016 to 2020), the world went through a trade war ⏤ made worse by the Covid-19 pandemic ⏤ and global trade, and trade finance survived.

As Allianz Global Investors points out: “A closer examination of broader data suggests Mr. Trump’s tariffs may have disrupted global trade only marginally.”

Chart 2: Global trade, 2015 to 2022

Notice a sharp drop in 2019, followed by the impact of the Covid-19 pandemic in 2020 (Source).

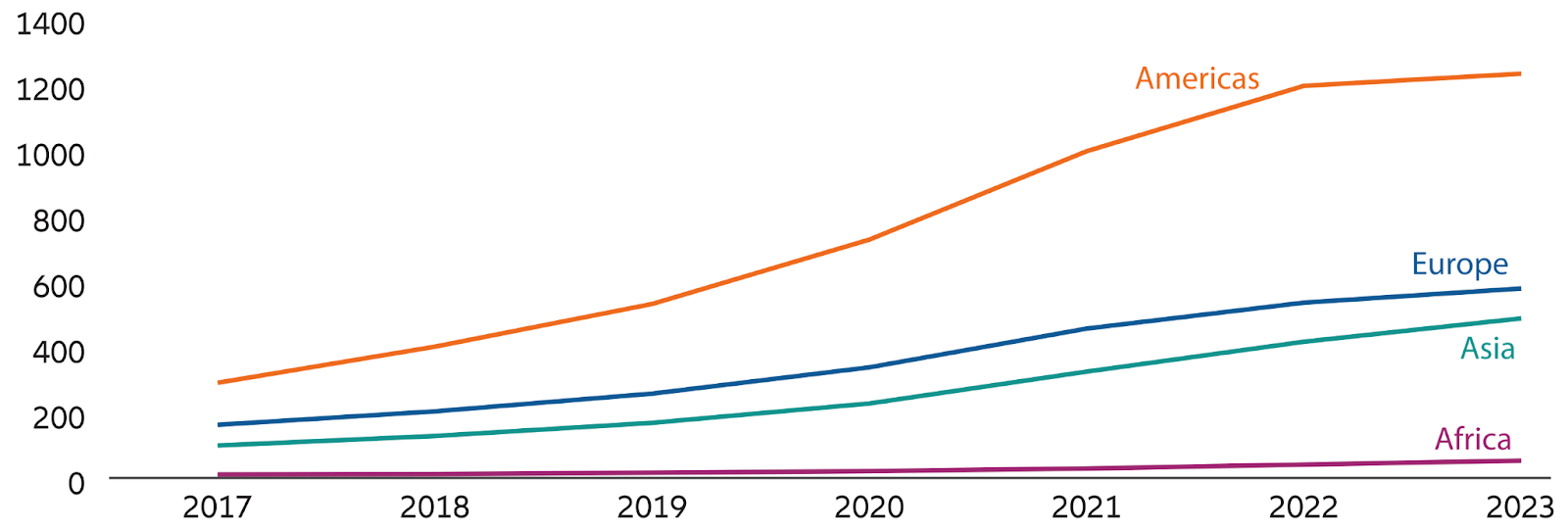

Chart 3: Trade finance growth after 2022

The total volume of supply chain finance – the trade finance most prevalent with global corporates – has grown by a compound annual growth rate of 26% from 2017 to 2023 despite potential headwinds from trade protectionism, according to an industry survey conducted by BCR Publishing.

Both charts are from Allianz Global Investors.

Based on the previous round of trade wars, we can be fairly confident that trade finance will continue to prosper. Data shows trade finance has a CAGR of 3.1%, and even factoring finance grew at 5% between 2017 and 2023, despite trade finance headwinds and uncertainties.

The global economy will keep growing, with the cost of tariffs already factored into 2025 projections: “Global growth is forecasted at a steady 2.8% through 2026, with varied recovery by region”, according to Allianz Trade.

The point is that if global trade and trade finance survived Trump 1.0, it can survive Trump 2.0.

- A Technical Team is Needed for Digitization

The last myth is that going digital in trade finance requires extra staff or in-house, custom-built software.

If you’ve got a technical team but they’re working on other projects, then you might be concerned that getting into trade finance is going to require a big upfront investment.

You’d be right, if you were going to build in-house software. A project like that would easily exceed 7-figures, between salaries, development costs, and other expenses. Even after the software was up-and-running, you’ve got ongoing staffing and other costs to consider.

End-to-end trade finance digitization can be implemented seamlessly, without the need for extra staff or in-house software builds.

As we showed in this article:

- Buying instead of building always comes with a much lower upfront investment.

- Subscribing to software means that you will avoid hidden costs associated with building.

- Software like LiquidX’s, gives your team elastic resources. Avoid bottlenecks and ensure smooth performance even as demands increase.

- LiquidX handles tens of billions in trade finance transactions every year without our clients needing to increase headcount, hire a technical team, or spend a fortune in upfront costs.

- LiquidX software is further supported by Broadridge Financial Solutions, an investment-grade Fintech company that provides operational support.

How Banks & Asset Managers Are Embracing Trade Finance Digitization

Trade finance is an opportunity for banks and asset managers, especially in turbulent times. The good news is that you don’t need to build trade finance software in-house, increase headcount, or fear the latest round of tariffs and trade wars.

If you’re already in the trade finance market, but using spreadsheets or out-of-date software, then that could be making it harder to manage. Your current processes could be missing details and data, making it not-fit-for-purpose.

Instead, you could embrace trade finance digitization and benefit from a partnership with LiquidX in the following ways:

- Automatically digitizes assets, and any invoice format (e.g., XLSX, PDF, etc.), in the front office (Trade).

- Turns these digital assets into workable data downstream across the trade lifecycle

- Manages portfolio risk with TradeHub.

- Make significant back office savings (TradeOps) 50% more cost-effective than developing in-house back office software.

- Can handle reconciliation challenges for asset managers (InMatch module).

Between LiquidX’s digital trade finance solutions and our partnership with Broadridge (NYSE: BR), we can help any bank or asset management firm get into the trade finance market.

Here’s another great reason to work with us! In December 2024, Global Business & Finance Magazine awarded LiquidX with three awards for the second year in a row:

- Best Digital Solutions For Global Trade United States 2025

- Best Technology Vendor Of The Year United States 2025

- Best Fintech For Trade United States 2025

Banks and asset managers: To request a demo of our trade finance distribution solutions, click here.