Increase Auto-Post Rates and Achieve 3-5x ROI

Managing credit and collections is difficult, but in the pharmaceutical industry, managing chargebacks and rebates adds an additional layer of complexity that other industries simply don’t have. Excel and home-grown databases might work fine initially, but as business grows, and your sales team creates new incentive programs, so do the reconciliation issues required to ensure you aren’t leaving money on the table. If you’re managing sales forecasts, incentive programs and deductions manually, you already know the headache.

With LiquidX’s digitization technology®, you can automate the entire process. Many software applications will help you automate the matching of Invoices and remittance advice, or help with OCR and digitization, but that’s not enough. It’s the exceptions that are the problem and that’s where LiquidX’s digitization technology® can help.

Solving the Data Problem

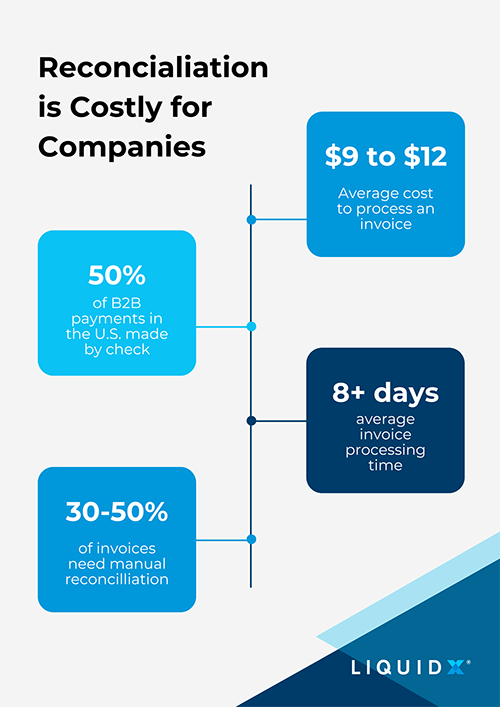

Reconciliation requires an alignment across an organization to match cash flows to remittance information to invoices with a high degree of precision. But several factors impact efficiency and drive up costs:

- Electronic payments often do not contain remittance information, which may be sent through a separate channel, such as email, logging into the customer’s website, or flat files.

- While checks often contain remittance detail, capturing this information upon receipt may require expensive keying services from the lockbox provider.

- The channel and format of remittance information is rarely standardized, requiring manual effort to rekey data.

- Payment data is sourced from bank reporting that varies in format and availability of data across banks.

When not performed efficiently, reconciliation can have a far-reaching effect on the broader organization, holding up cash application, tying up credit lines, and burning staff hours.

Any Digital Solution Must Solve Three Key Issues

Payment reconciliation is a time-consuming, manual process. Until now, digital reconciliation solutions have fallen short in tackling three key issues:

Complex Cash Application

Cash Application functions typically manage hundreds to thousands of bank accounts globally, spread across multiple banking partners, supporting different currencies, and carrying the burden of managing country tax and legal rules that govern the movement of cash. As money moves internationally from customer to supplier, the value of the payment is impacted by currency conversion and processing fees lifted from the payment principal.

In recent years, the adoption of SWIFT GPI has provided greater insight into transaction fees, however the payment value is impacted by deductions that are outside of GPI reporting.

Handling Payment Values

Payment value is also impacted by disputes that arise between customer and supplier. The disputes may lead to credit notes and deductions, which require additional effort to track through the order to cash process, as well as investigations that further delay the reconciliation process.

External Working Capital Programs

Finally, the process is further complicated when payments are financed through working capital programs such as Invoice Factoring, Dynamic Discounting, and Supplier Financing. These financing methods require connecting cash flows whose payment dates and remitting entity are likely to change.

Cash application teams must aggregate this information across different data sources, often from disparate platforms and systems.

Problem Solved

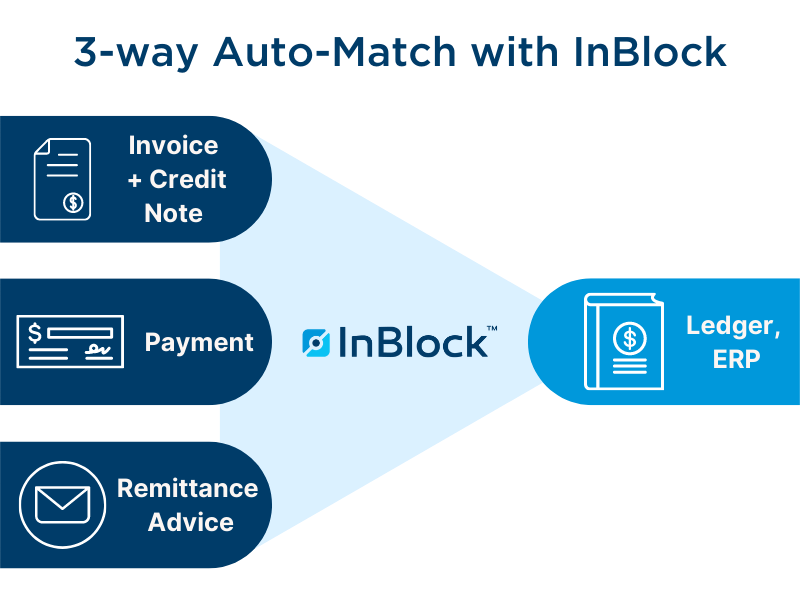

LiquidX’s digitization technology® automates reconciliation by digitally ingesting and transforming remittance information across multiple data sources and matching it with invoice and payment details. Taking it a step futher, LiquidX’s digitization technology® optimizes the process using machine learning to continuously enhance the matching logic in the system.

Real-time payment reporting from banks flows into LiquidX’s digitization technology® via API connectivity. The API connection ensures that once a payment is posted to the account, it is identified for reconciliation. LiquidX’s digitization technology® also receives lockbox payment detail using Optical Character Recognition (OCR) scanning to reduce the need for keying services. This feature leverages existing agreements with the LiquidX® banking network and does not require any changes to the set-up in place with a bank provider.

As a result, LiquidX’s digitization technology® can then predict timing of cash flows, detect and automate customer behaviors, and identify potential errors, increasing the auto-match rate up to +95%. The rich asset history stemming from the digital cash flows vastly improves payment certainty and cash forecasting, boosting metrics such as Days Sales Outstanding and Average Days Delinquent.

Digital transformation doesn’t have to be complicated. LiquidX’s digitization technology® delivers a turn-key set of tools that work alongside and are integrated into your ERP to deliver game-changing efficiency. Read more about bringing digitization into your supply chain here.