Trade finance makes the world go round. An impressive 80 to 90% of global trade relies on trade finance, according to the World Trade Organization (WTO).

Trade finance is a massive market and for some banks, one that remains untapped. Trade finance solutions can help banks gain access to the trade finance market, creating new growth opportunities.

TL;DR:

- Trade finance solutions are end-to-end software platforms (SaaS) that make it easier for banks to provide trade finance for current and new customers.

- Trade finance is a huge market. Data shows trade finance is expected to hit $9.7 trillion in 2025 with a compound annual growth rate (CAGR) of 3.1% (market report).

- There’s a good chance that you’ve got customers who need this service. If your customers can’t get trade finance ⏤ trade credit and insurance/guarantees ⏤ from your institution, they have to go to another bank or short-term trade finance lender.

- The good news is banks and financial institutions can get into the trade finance market much easier and quicker than you might think.

- Between LiquidX’s trade finance solutions and our partnership with Broadridge (NYSE: BR), a trusted global fintech leader, we can help any bank get into the trade finance market.

In this article, we look into the current state of the trade finance market and show you how banks can get up and running with a trade finance solution without having to invest in having customized software built or increasing headcount.

The Role of Banks in Trade Finance

Banks play an integral role in facilitating trade finance.

There’s a very good chance that a lot of what you buy online and in supermarkets every week is available partly or completely as a result of the flow of trade finance.

Trade finance is not a new concept. The modern banking system is built on the foundations of 15th-century European trade finance systems and the banks of that period, such as the Medici Bank.

Modern trade finance involves smoothing the flow of capital between numerous organizations:

- Banks

- Insurers

- Importers and exporters

- Shipping companies

- Trade finance providers

- Export credit agencies and third-party service providers

A great example of how trade finance works in practice is in bridging the trust gap between importers and exporters.

Imagine the problems importers and exporters face in their daily business operations:

- Importer: What if I pay for the goods and they aren’t shipped?

- Exporter: What if I ship the goods and don’t get paid?

- Both: What happens if the shipment is lost or stolen en route?

- Both: How do we pay for the shipping and goods being handled in transit before the transaction is complete (making cash flow easier)?

Letters of credit (LC), invoice factoring, trade finance, and various insurances solve these issues. Trade finance de-risks every transaction, and trade finance software solutions facilitate the entire end-to-end process.

If, as a bank or financial institution, you aren’t already in the trade finance market, then here are a few factors you might want to consider:

- Trade Finance is a high-growth finance sector, currently worth $9.7 trillion, with a CAGR of 3.1%.

- 80 to 90% of global trade relies, in some way, on trade finance.

- There is currently a massive trade finance gap, estimated to reach $2.5 trillion in 2025, according to the International Asian Development Bank. This trade finance gap is especially high in Africa, Asia, and the United Arab Emirates (UAE).

Now, let’s look at the current state of the trade finance market, and how a bank can implement a new trade finance solution.

The State of Trade Finance in 2025

Trade finance in 2025 might be somewhat different to how things have been over the last four years.

Now that U.S. President Trump has taken the oath of office, the second Trump administration has begun.

Naturally, this has importers, exporters, and organizations in the trade finance sector wondering: How will these proposed tariffs affect us?

Trump is proposing:

- 10-20% tariff on all imported goods

- 60% tariff on all imports from China

- 25% tariff on all imports from Mexico and Canada, except for U.S. automakers importing vehicles from Mexico who are poised to face a 100% tariff

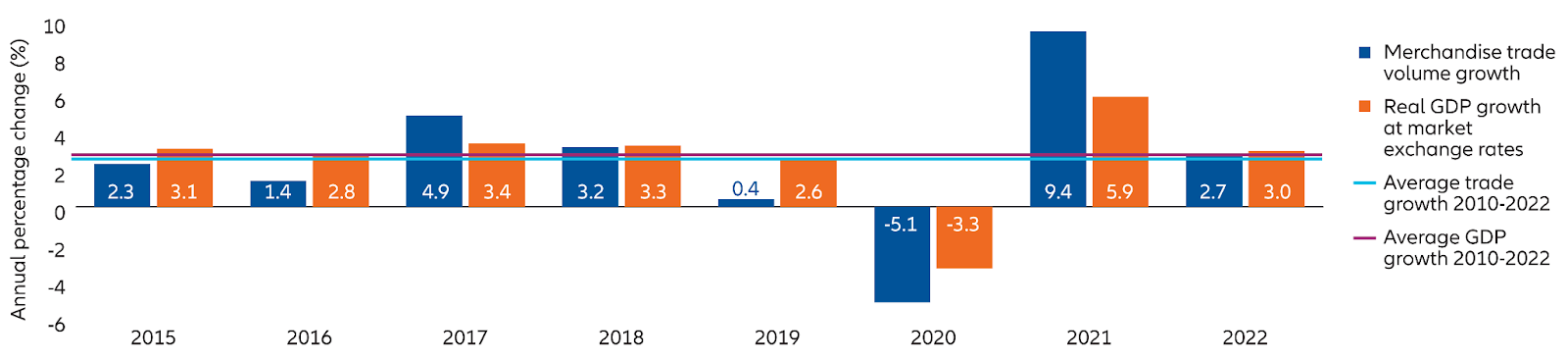

We have been here before (2016 to 2020), and global trade and trade finance didn’t come to a screeching halt.

Global trade did decelerate in 2019 when President Trump imposed tariffs during his first term in office. However, as Allianz Global Investors points out: “A closer examination of broader data suggests Mr. Trump’s tariffs may have disrupted global trade only marginally.”

Chart 1, below: Global trade, 2015 to 2022. Notice a sharp drop in 2019, followed by the impact of the Covid-19 pandemic in 2020 (Source).

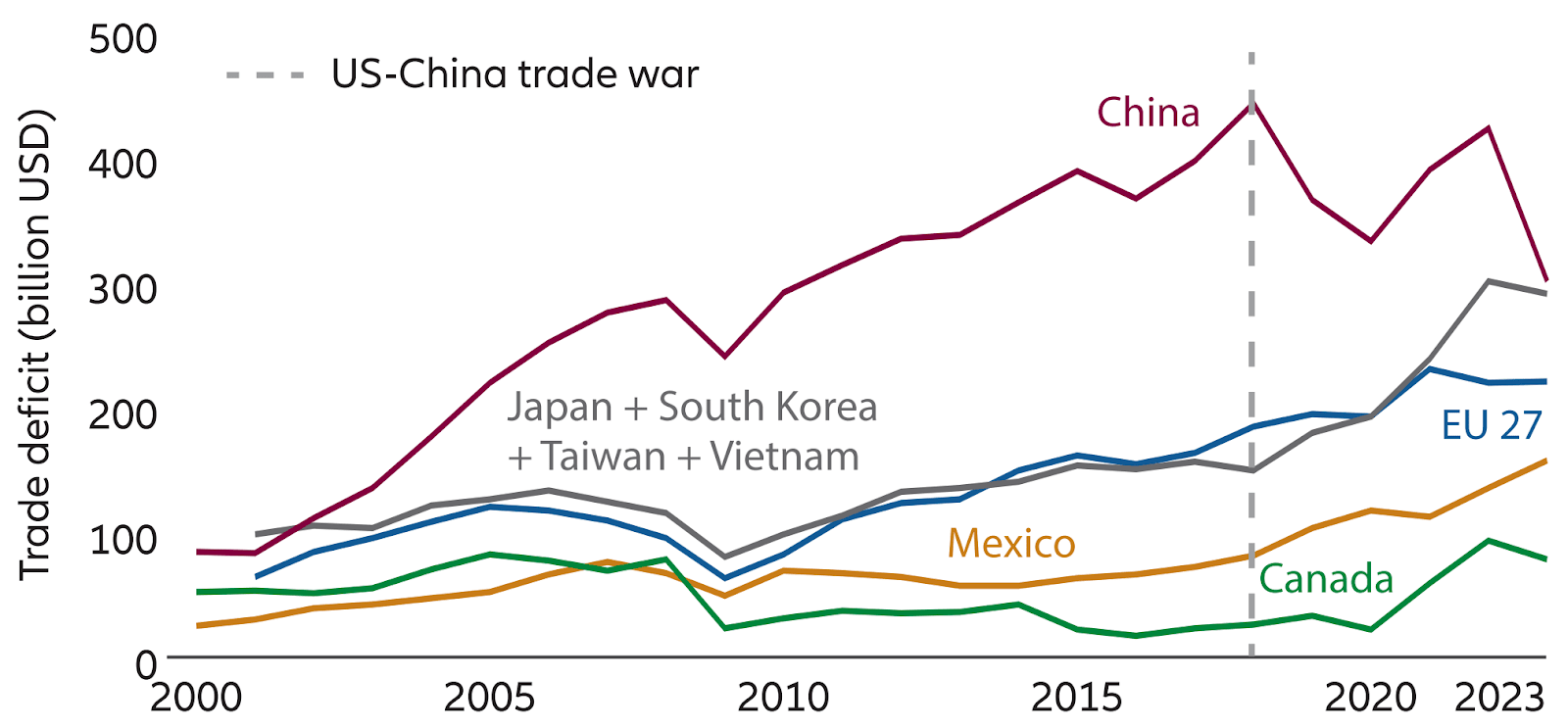

Chart 2, below: Following the imposition of tariffs, the U.S. trade deficit with China reduced as the U.S. imported more from other countries (Source).

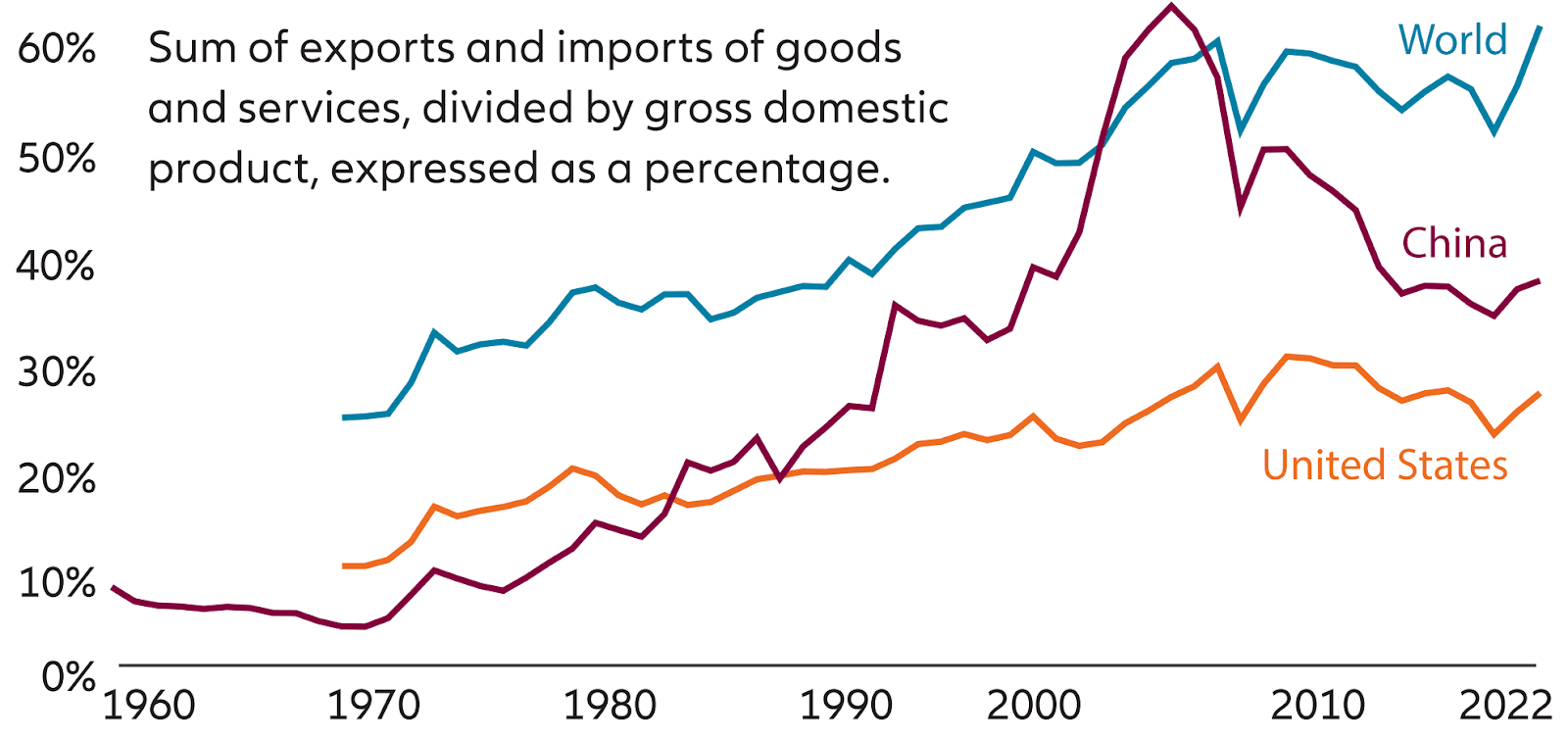

Chart 3, below: Despite the tariffs, international trade as a share of global GDP exceeded 60% for the first time in a decade (Source).

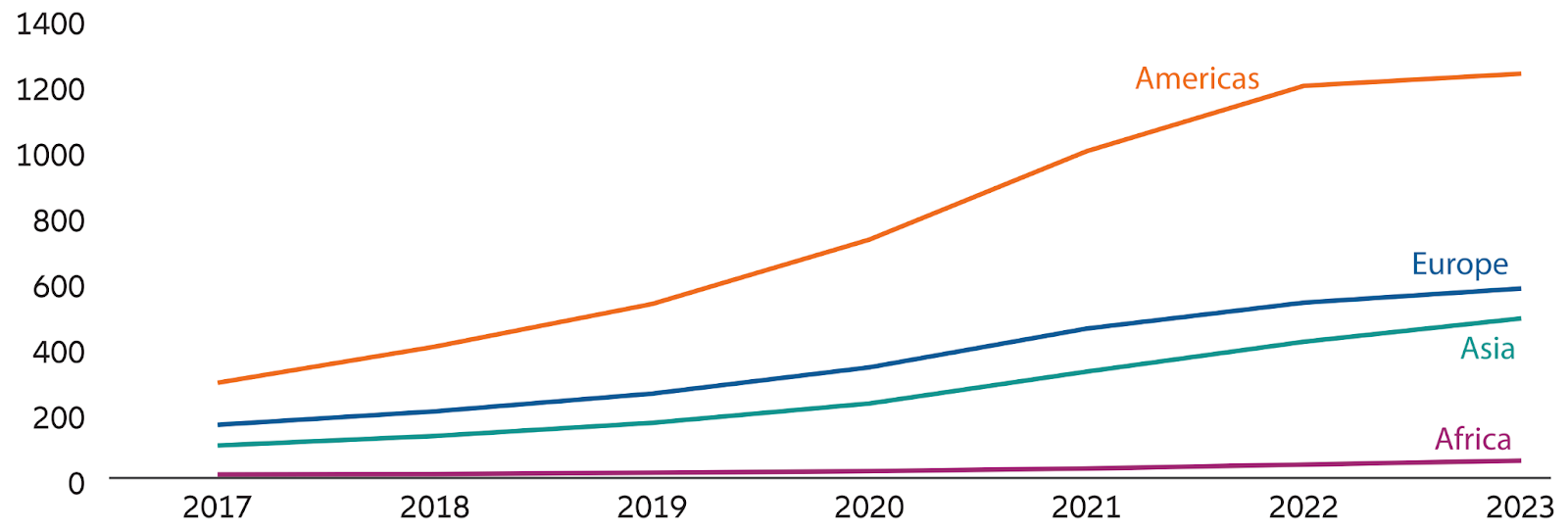

Chart 4: Trade finance continued to grow during that period. The total volume of supply chain finance – the trade finance most prevalent with global corporates – has grown by a compound annual growth rate of 26% from 2017 to 2023 despite potential headwinds from trade protectionism, according to an industry survey conducted by BCR Publishing.

All charts from Allianz Global Investors.

Analysis from Allianz Global Investors notes: “Growth has been more muted in other segments of trade finance. Factoring, used by small businesses and mid-market companies to raise finance against their invoices payable by high-quality buyers, has seen a compound annual growth rate of about 5% over the 2017 to 2023 period, according to Factors Chain International (FCI), which monitors the total volume of factoring. But the rate of growth still exceeds G10 [top 10 national economies] annual GDP or world trade growth, indicating factoring is still integral to financing commercial trade.”

Banks can take comfort knowing that:

- Supply trade finance grew at a CAGR of 26% from 2017 to 2023 despite an increase in global protectionism and tariffs.

- Factoring finance still grew at a rate of 5% during that same period, despite the same headwinds and uncertainty.

- Overall, trade finance is still worth $9.7 trillion, with a CAGR of 3.1%.

- The world economy is still predicted to grow, with the cost of tariffs already factored into 2025 projections: “Global growth is forecasted at a steady 2.8% through 2026, with varied recovery by region”, according to Allianz Trade.

In response to proposed tariffs and to benefit from being a player in the trade finance sector, banks can launch or increase the following financial programs:

- Payables programs so buyers can extend payment terms while suppliers receive early payments, enhancing working capital for both parties.

- Receivables programs so businesses can convert their receivables into immediate cash, improving cash flow to help navigate volatile times.

- Working capital programs strengthen supplier relationships, improving liquidity, funding innovations, and making international trade easier for nervous buyers and sellers.

As a bank, you could soon implement a whole suite of trade finance services for cross-border customers.

This is much easier to do with the right trade finance software partner. LiquidX is the only suite of trade finance solutions that banks can use to implement and manage trade finance programs without increasing headcount or investing in expensive in-house software.

How Banks Can Implement Trade Finance Solutions

Compared to other financial asset classes, trade finance is still too heavily reliant on emails, paper, and even fax.

Banks that continue to rely on old methods and outdated in-house or custom-built software risk being left behind.

The only way to implement trade finance successfully, without scaling headcount and costs, is to partner with a provider who can handle everything for your bank.

Not only that, but working with a trusted, award-winning partner like LiquidX, means that your whole trade finance suite can be implemented white-label. Find out more about the LiquidX Partner Program (LPP).

LiquidX’s suite of trade finance solutions can handle everything, with a smooth-running turnkey front-, middle- and back-office operation that manages the entire origination to reconciliation lifecycle.

As a bank, your team will need the following to provide trade finance for your customers:

Here’s what you can benefit from when you partner with LiquidX:

- Trade finance software that can take in any invoice format (e.g., XLSX, PDF, etc.), and use that as workable data downstream across the trade lifecycle.

- Automatically digitizes assets in the front office (Trade).

- Manages portfolio risk with TradeHub.

- Make significant back office savings (TradeOps); up to 50% savings compared to in-house back office software.

- Can handle reconciliation challenges for global and regional banks (InMatch module).

- Includes the advantages of a deep partnership with Broadridge (NYSE: BR), a trusted global fintech leader. Broadridge is LiquidX’s largest committed investor and strategic operational services provider for payment processing, account reconciliation, and global operational scalability.

Key Takeaways: Trade Finance for Banks

As we enter a potentially turbulent economic climate, trade finance has never been more important.

Banks ⏤ and their cross-border, international, importing, and exporting SMB and corporate customers ⏤ benefit from having their trade finance in safe hands.

If your trade finance programs need an upgrade, or you’re considering getting into this market then talk to us. We are a trusted trade finance partner that’s managed billions in transactions for U.S., European, and international banks.

LiquidX is the only single-source solution for empowering an entire trade finance business. Combined with our partner Broadridge, we support financial institutions to provide working capital solutions to their corporate clients in a single, intuitive interface.

💡And here’s another great reason to work with us! In December 2024, Global Business & Finance Magazine awarded LiquidX with three awards for the second year in a row:

- Best Digital Solutions For Global Trade United States 2025

- Best Technology Vendor Of The Year United States 2025

- Best Fintech For Trade United States 2025

Banks: To request a demo of our end-to-end digital solution, click here.