By Todd Lynady, Managing Director & Global Head of Insurance at LiquidX

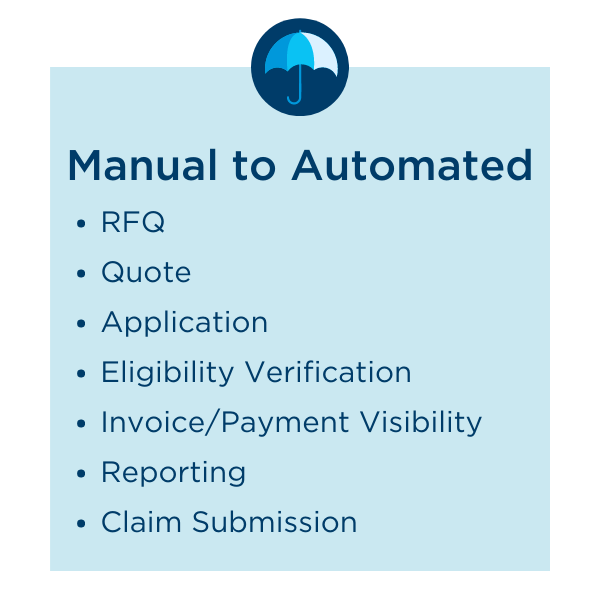

The financial aspects of B2B trade can be complicated, and trade credit insurance is no exception. The process of requesting, securing, and managing policies is manual, complex, and difficult to streamline. Fortunately, new technology solutions are replacing the manual processes in trade credit insurance.

Why Are Practitioners So Excited?

Putting a policy in place is typically a long, tedious and multi-step process. In many cases there are more than 30 touch points between a submission and policy issuance. Most brokers still attach an application to an email and send it to ten or more carriers. Underwriters review submissions and undertake an internal workflow to log the submission into their system.

At the same time, the underwriter must manage an external workflow to clarify submissions, request additional information, or quote in response to brokers. Once all responses are received, the broker painstakingly collates each carrier’s proposal and manually re-enters this data into an excel spreadsheet or other internal system which is then presented to the prospective insured. This is an incredibly inefficient, manual, and resource-intensive process that some brokers estimate takes up 40% of their time and as long as four to six weeks.

Why Now?

The required technology has caught up with the dream. According to a study by McKinsey & Company, five technology trends, individually and in combination, are having a “seismic impact” on the insurance industry. These trends include:

- Distributed infrastructure: Distributed systems, such as the cloud, have allowed for reliability, scalability, and flexibility, both in terms of launching new products and servicing clients.

- Next level automation: Process automation streamlines system workflows through automation, increasing response time, decreasing the chance for errors, and delivering cost savings.

- Network connectivity: Connecting networks dramatically increases the speed of service delivery and enables a view across the enterprise, releasing data that was previously stuck in silos.

- Trust architecture: Sensitive information must be safeguarded as it passes between carrier, broker, and policyholder. Distributed Ledger Technologies such as blockchain enable validation and visibility from all sides.

- Applied artificial intelligence (AI): Artificial Intelligence makes smart systems even smarter by recognizing patterns and becoming more predictive.

These tech innovations are all reflected in the LiquidX solution, which gives policyholders, brokers, and insurers the power to modernize and transform their credit insurance operations.

What Does Digitization Do for Credit Insurance?

Digitization converts the policy into a smart contract that enables brokers and insureds to replace manual, resource intensive policy management and compliance processes with automation. This means digitizing an insurance policy and the invoices it covers, literally turning them into lines of code and into smart contracts. Once this occurs the policy terms and conditions are self-executing and dynamically interact with other smart contracts.

In the case of LiquidX’s digital insurance solution, a variety of connective technologies that enable “digital handshakes” between the various parties – carriers, brokers, and policy holders – are used to exchange data.

With digitized policies, participants can quickly verify that accounts receivable are eligible for coverage, confirm debtor authenticity via direct API to credit bureaus like Dun & Bradstreet, track performance of each covered receivable, and automate reporting requirements.

In addition, with workflows and information now interconnected across the entire trade credit insurance ecosystem, richer data can be generated to help inform risk management and other corporate decisions. Data from each “smart” policy provides aggregated position and risk monitoring – across debtors, insurers, policyholders, or geographies – allowing brokers, carriers, and insured parties Future is Here

The Future is Here

At LiquidX, we are charting a new path in the digital transformation of trade credit insurance, completely changing how policies are purchased and managed across the entire value chain. The challenges of the past two years have emphasized the need for a coherent digital strategy, and clients are demanding more from their brokers and insurers. Our LiquidX’s digitization technology Digital Policy Management solution not only increases efficiency and scalability for all constituents, but more importantly, the transparency it provides mitigates operational risks across the value chain.

Our aim is to help grow the market for brokers, carriers and insured parties by improving access to coverage, providing transparency, and managing the often-cumbersome policy management, compliance, and claims processes.

Todd Lynady is Managing Director and Global Head of Insurance at LiquidX. Reach Todd at [email protected] or +1 718-866-8454.