Trade finance distribution is a way of unlocking liquidity from trade finance products. Originators are usually banks, fintechs, or non-banking finance providers who can then sell or distribute individual or groups of trade finance products to other investors in the market.

Trade finance distribution is usually done on an “originate-to-distribute” (OTD) model to ensure an originator isn’t inadvertently holding onto too much trade finance exposure on their balance sheets.

Distribution is an increasingly popular alternative asset because it unlocks opportunities and growth revenue for every party in the transaction.

In this article, we will look at trade finance distribution in more detail, and why and how financial institutions can get into or scale-up operations in this market.

But first . . .

What about tariffs and trade wars: Won’t these harm trade finance?

As the world financial markets have experienced in recent weeks, the Trump administration has taken the U.S. economy to the edge of recession, and the world to the brink of an all-out trade war.

It took a surge of sell-offs in the huge $28 trillion U.S. Treasury Bonds market, pushing yields on 10-year bonds as high as 4.5% on Friday 4, April, before finally, Trump backed down on tariffs.

Tariffs are “paused” for 90 days, sitting at 10% across the board, except for China which is still “temporarily” at 125%. China has responded in kind, putting tariffs on U.S. goods to 125%. Stock and bond markets reacted well to the news, with the biggest single-day gains since the end of World War II.

With bond yields up and markets down, tariffs and the consequences of retaliatory tariffs made no strategic sense. The only thing “Liberation Day” seemed to achieve was the liberation of trillions of dollars of shareholder value from stock markets.

The ongoing problem is that it’s hard to predict what this administration will do next. Investors are nervous. No one wants a recession.

You need a way to de-leverage risk in your organization’s portfolio. Trade finance distribution is one way to do that. However, given the unpredictable nature of the Trump administration, you might be worried about whether this is a good investment anymore.

Fortunately, we’ve done our homework and looked into what happened between 2017 and 2023, during previous tariffs and trade wars. As Allianz Global Investors points out: “A closer examination of broader data suggests Mr. Trump’s tariffs may have disrupted global trade only marginally.”

As the data proves:

- Supply trade finance grew at a CAGR of 26% from 2017 to 2023 despite an increase in global protectionism and tariffs.

- Factoring finance ⏤ mainly used by small businesses and mid-market companies to raise finance against their invoices payable ⏤ still grew at a rate of 5%, despite the same headwinds and uncertainty.

This is why we’re fairly confident that even with new tariffs, trade finance won’t be dramatically impacted, and growth in this market is set to continue.

As unsettling as these sudden changes and market swings are, they should be a temporary issue and not something that will impact trade finance or trade finance distribution in the mid- to long-term.

Size of the trade finance market opportunity

Trade finance is a fast-growing market. 80 to 90% of world trade relies on trade finance which is currently worth $9.7 trillion, with a CAGR of 3.1%.

Trade finance distribution is the most effective way to monetize this multi-trillion-dollar market.

It’s a powerful way for enterprise-scale corporations to monetize funds currently sitting dormant. According to HBR research: “Non-banking U.S. firms have increased their hoards of cash, reaching $6.9 trillion, an amount larger than the GDP of all but two countries.” Hence why corporate treasuries are getting into this market.

Banks are keen to expand on this opportunity too. Especially since trade finance won’t be affected by Basel III Endgame rules, which will start to be phased in on July 1, 2025.

As the IMF noted, the 37 Tier-1 banks (with over $100 billion on their balance sheets) can monetize trade finance without worrying about Basel III because trade finance is “low-risk, highly collateralized . . . with a very small loss record.”

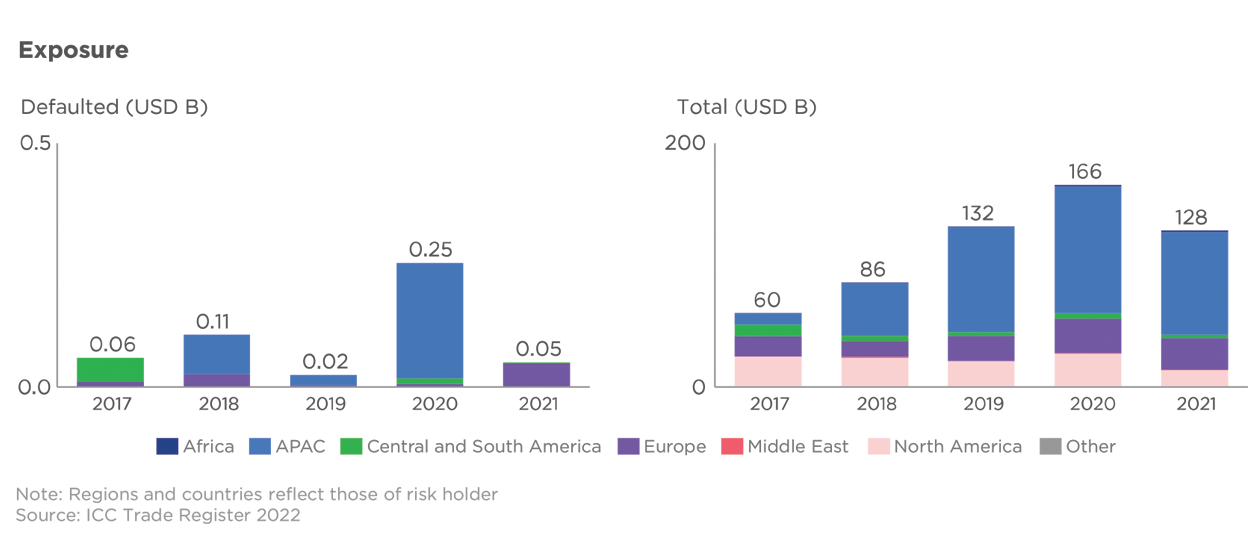

This low-risk nature of these financial instruments makes them a more attractive opportunity in turbulent times. In most cases, default rates are under 0.25%. *

Table 1: The default rates of trade finance distribution have always been low

Low-risk and very low default rates for the following popular trade finance distribution financial instruments: accounts receivable (AR) and supply chain finance (SCF) (source)

There are numerous types of trade finance, including but not limited to the following:

- Supply Chain Finance (SCF)

- Accounts Receivable (AR)

- Invoice Factoring (IF)

- Pre and Post-Shipment Financing

- Distributor Financing

- Reverse Factoring

There are also numerous players in this vast interconnected market:

- Asset managers

- Corporates

- Banks

- Insurers

- Importers and Exporters

- Shipping Companies

- Non-bank, Trade Finance Providers

- FinTech SaaS Providers

- Export credit agencies and third-party service providers

Any party can act as an originator for a distribution deal, although it’s usually a financial provider, like a bank, asset management firm, or corporate treasury.

Any party can also act as a buyer, or intermediary, depending on the deal terms. Distribution products can be anything from short-term, relatively small bundles of finance, like $1M over 90 days, or much larger and longer-term assets.

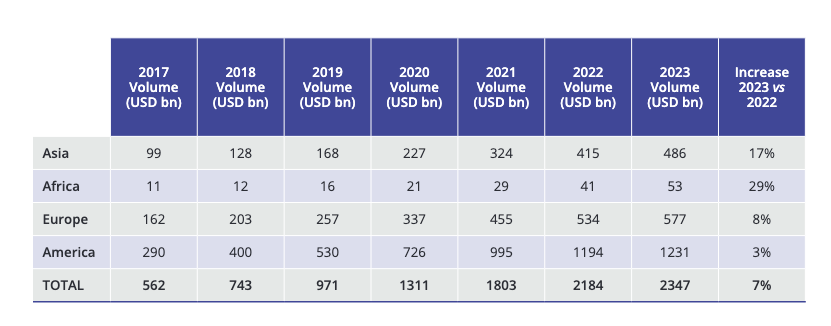

One growth area is supply trade finance. It grew at a CAGR of 26% from 2017 to 2023 despite an increase in global protectionism and tariffs.

SCF continues to grow at a rate of “7% annually, currently worth $2.34 trillion, with funds in use (FiU) at $916 billion,” according to the latest BCR Publishing’s World Supply Chain Report 2024. (2023 figures).

Trade finance opportunity gaps

The opportunity gaps are wherever there are shortfalls in the trade finance market. For those, we need to look at Asia, the Middle East, and Africa (MENA).

One consequence of tariffs is trade diversification. Imports to the U.S. are likely to drop, but that means that manufacturers and exporters will be looking for new markets for their products.

In turn, this creates opportunities for trade finance and trade finance distribution. Now is the time to look at your presence in Asia, particularly South East Asia, and MENA.

The following countries and regions are largely untapped markets for trade finance: Africa, Asia, China, India, and the United Arab Emirates (UAE), worth $2.5 trillion, according to the International Asian Development Bank.

Table 2: Asia and Africa are seeing the fastest growth in volume of SCF: Up 29% and 17% Year-on-Year (YoY), respectively

Source: World Supply Chain Report 2024.

Who’s getting into the trade finance market?

We’ve seen a lot more asset managers get into this market in the last few years.

Asset managers are injecting capital as a way of generating higher returns compared to other asset classes like real estate or bonds. It’s proving a great way to offset portfolio risk, especially if a portfolio is holding onto too many stocks, bonds, and ETFs.

For the same reason, banks, institutional investors, non-bank lenders, and alternative credit funds, are getting into distribution, or being more aggressive with scaling their current trade finance activities.

Do we need to increase headcount to get into trade finance?

The good news is that you shouldn’t have to increase headcount if you want to get into this market.

You could get right into the thick of things, buying contracts, letters of credit, and even invoices for a percentage of the revenues.

Or you could make investments through trade finance syndicates. In these cases, your firm will be one or two layers removed from the actual trade finance assets themselves. This de-risks it, but the rewards in turn are usually slightly lower.

In either scenario, you can get into this market without increasing headcount.

For financial institutions, LiquidX’s white-label platform enables seamless integration of trade finance services into your existing offerings, allowing you to leverage LiquidX’s technology while maintaining your brand identity.

With our capabilities and a deep partnership with Broadridge (NYSE: BR) ⏤ a trusted global fintech leader ⏤ you can outsource this function completely without needing to recruit more staff.

Our software takes care of everything, from digitization at one end to distribution at the other. It’s a modular platform, so you can simply use distribution without needing everything else.

For corporations wanting to leverage trade finance distribution advantages, LiquidX’s digitization technology converts invoices into self-executing smart contracts, enhancing visibility and efficiency throughout your working capital lifecycle.

FinTech SaaS partners can benefit from seamless integration with your existing systems which reduces administrative overhead through automated processes.

Whether working on a white-label basis or not, we’ve never had to encourage a client or partner to scale their headcount to get into trade finance distribution operations.

Key takeaways: Time to get into trade finance distribution

Trade finance distribution is sometimes seen as a difficult market to get into. It’s an alternative asset, and as such, they’re not understood as well as other financial instruments.

It’s one of the reasons Trade Finance Global launched the TFG Distribution Finance initiative in July 2023. The aim of this and similar initiatives is to:

“Identify and address unmet demands in the trade finance market, working towards closing the $2.5 trillion trade finance gap – a significant barrier to international trade impacting mid-market companies and small to medium-sized businesses in particular.”

One of the challenges is managing the flow of information and documentation. However, you can solve this with LiquidX’s tool for managing multiple sources of data that is platform-agnostic. This makes getting into distribution a lot easier.

Trade finance distribution is a high-growth opportunity for banks, asset managers, institutional investors, non-bank lenders, and alternative credit funds.

Here’s another great reason to work with us! In December 2024, Global Business & Finance Magazine awarded LiquidX with three awards for the second year in a row:

- Best Digital Solutions For Global Trade United States 2025

- Best Technology Vendor Of The Year United States 2025

- Best Fintech For Trade United States 2025

Banks and asset managers: To request a demo of our trade finance distribution solutions, click here.

* Naturally, as with every financial product, there are risk factors. No investment is ever zero risk, and past performance of any asset class doesn’t always mean that future results will be the same. Please assess your organization’s risk appetite before making any new investment decisions. This article does not constitute investment advice in any way.