Trade finance is relatively low-risk, self-collateralized, and generates healthy returns in a short timescale.

For those reasons, asset managers ⏤ especially private credit, and debt ⏤ trade finance is an increasingly attractive market to get into.

Trade finance comes in several forms:

- Supply Chain Finance (SCF)

- Accounts Receivable (AR)

- Invoice Factoring (IF)

- Pre and Post-Shipment Financing

- Distributor Financing

- Reverse factoring

There’s no unified language for this sector, despite the International Chamber of Commerce (ICC) publishing a Standard Definitions for Techniques of Supply Chain Finance document in 2016, so we will simply refer to it as working capital monetization or use specific terms like supply chain finance (SCF) or accounts receivable (AR).

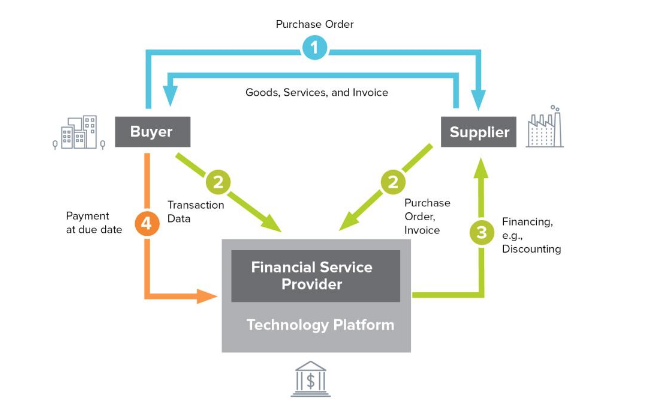

Working capital monetization is a complex market with multiple players involved at every stage:

- Corporates

- Banks

- Insurers

- Importers and exporters

- Shipping companies

- Trade finance providers

- Export credit agencies and third-party service providers

Modern trade finance involves smoothing the flow of capital between any number of these organizations.

Asset managers are now playing a role in this market, injecting capital as a way of generating higher returns compared to other asset classes like real estate or bonds.

In this article, we will take a closer look at why asset managers can get into the working capital monetization market. For alternative asset firms already in this market, we’ll look at ways you can invest in trade finance more effectively.

The flow of funds and documents in supply chain finance (SCF) (source)

Why is Trade Finance Growing Fast?

Trade finance is a fast-growing market. 80 to 90% of world trade relies on trade finance which is currently worth $9.7 trillion, with a CAGR of 3.1%.

There’s an enormous opportunity in largely untapped markets: Africa, Asia, China, India, and the United Arab Emirates (UAE), worth $2.5 trillion, according to the International Asian Development Bank.

Banks are increasingly keen to sell working capital assets to participant funders too, partly thanks to uncertain economic times, and the impending gradual phase-in of Basel III Endgame rules, which starts on July 1, 2025.

Despite all of the rules around Tier-1 banks (especially the global 37 with over $100 billion on their balance sheets), trade finance is “clearly not the target of the re-regulation exercise” because they are “low-risk, highly collateralized . . . with a very small loss record”, as the IMF noted in a policy paper about Basel III in 2014.

At the same time, global corporations are holding onto huge cash amounts. According to HBR research: “Non-banking U.S. firms have increased their hoards of cash, reaching $6.9 trillion, an amount larger than the GDP of all but two countries.”

CFOs and corporate treasurers wanting to make some of that money work harder for them are finding innovative ways to do this, including working capital monetization.

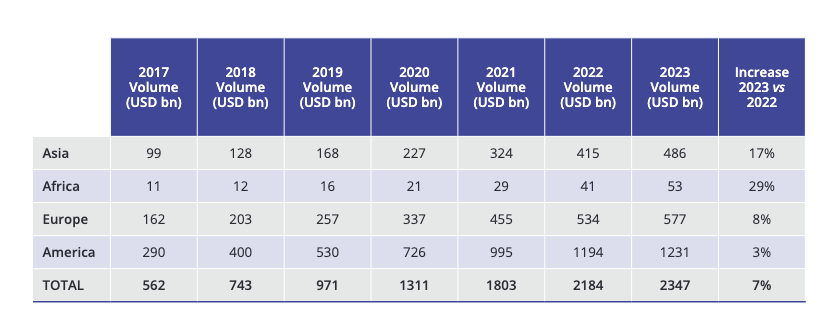

Supply chain finance continues to grow at a rate of “7% annually, currently worth $2.34 trillion, with funds in use (FiU) at $916 billion,” according to the latest BCR Publishing’s World Supply Chain Report 2024. (Based on 2023 figures).

Supply trade finance grew at a CAGR of 26% from 2017 to 2023 despite an increase in global protectionism and tariffs. Factoring finance ⏤ one sub-sector of SCF ⏤ still grew at a rate of 5% during that same period, despite the same headwinds and uncertainty.

Notice the high growth of SCF from 2017 through to 2023

Graph from: World Supply Chain Report 2024.

An analysis of trade finance by Allianz Global Investors notes: “Growth has been more muted in other segments of trade finance. Factoring, used by small businesses and mid-market companies to raise finance against their invoices payable by high-quality buyers, has seen a compound annual growth rate of about 5% over the 2017 to 2023 period, according to Factors Chain International (FCI), which monitors the total volume of factoring.”

“But the rate of growth still exceeds G10 [top 10 national economies] annual GDP or world trade growth, indicating factoring is still integral to financing commercial trade.”

We need to remember that the 2017 to 2023 period included President Trump’s first term in office when there were tariff charges. Despite these, and despite the Covid-19 pandemic, trade finance continued to grow. As Allianz Global Investors points out: “A closer examination of broader data suggests Mr. Trump’s tariffs may have disrupted global trade only marginally.”

This is why we’re fairly confident that even with new tariffs, trade finance won’t be dramatically impacted, and growth in this market is set to continue.

Asia and Africa are seeing the fastest growth in volume of SCF: Up 29% and 17% Year-on-Year (YoY), respectively

Graph from: World Supply Chain Report 2024.

With all of that in mind, this market seems like an opportunity that can’t be missed.

Why are Asset Managers Getting into Trade Finance?

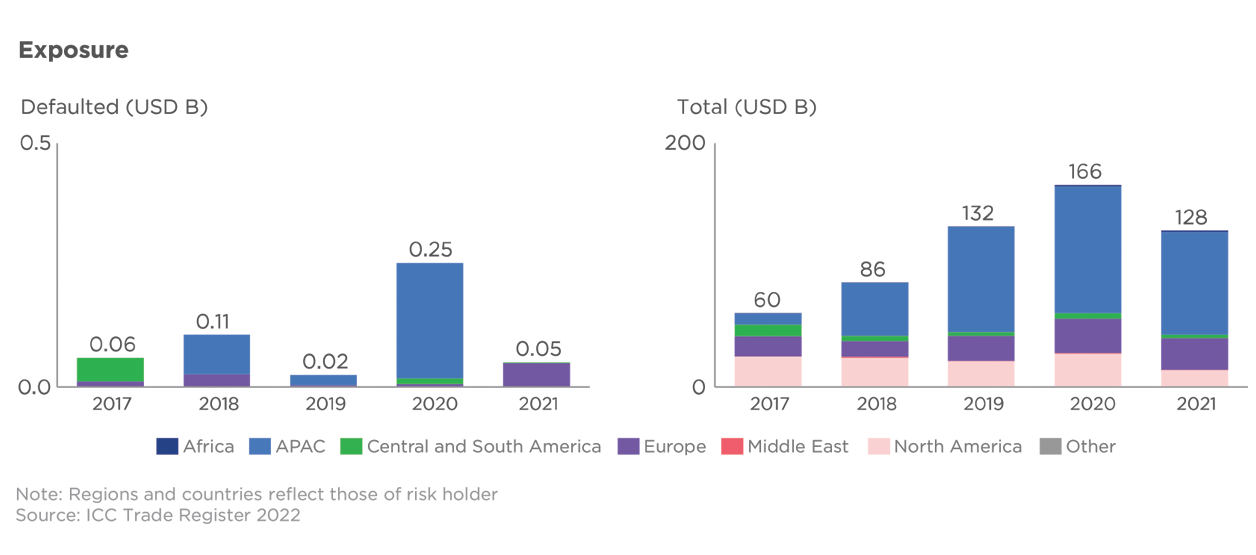

One of the main reasons working capital monetization is so attractive to asset managers, banks, corporate CFOs and treasurers is the fact that it’s such a low-risk asset class.

Trade finance instruments are always short-term, self-financing, and can be insured. This makes them very attractive from an investor perspective, de-risking working capital financial vehicles for asset managers looking to generate outsized returns in a short timescale.

That’s the other major advantage: Whether it’s invoice factoring, accounts receivable, or SCF, everything is collateralized. The timescales are also usually short ⏤ anywhere from 3 to 12 months.

Unlike other asset classes, such as debt financing or even real estate, the default rates of working capital monetization have always been low.

Low risk and very low default rates for accounts receivable (AR) and supply chain finance (SCF) (source)

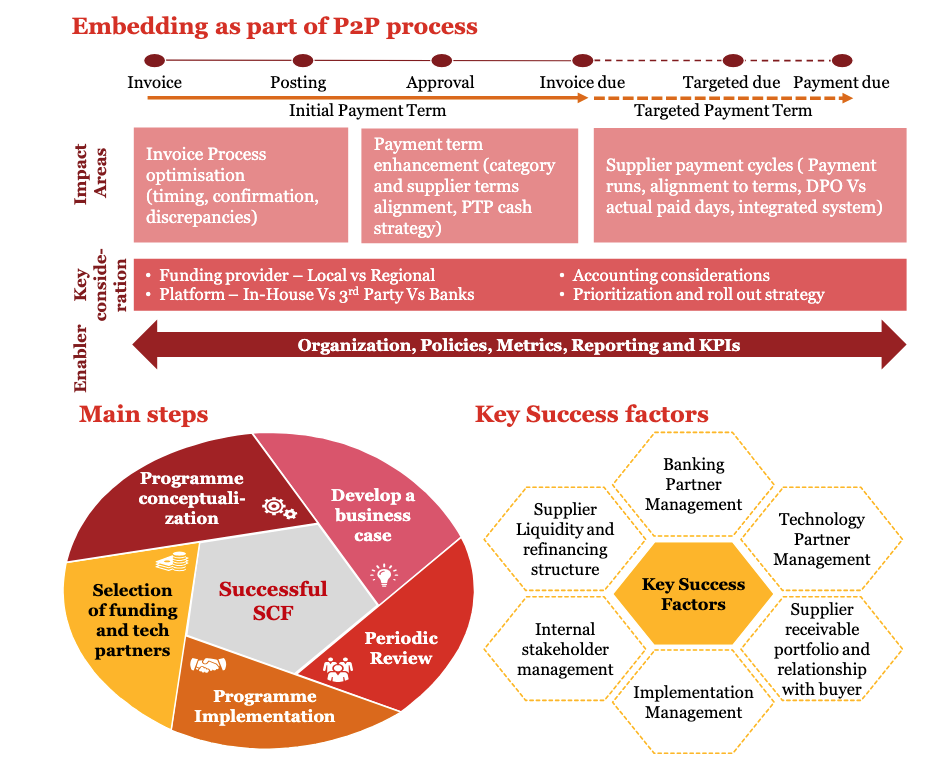

Here is the process PwC recommends for working capital monetization:

“[To] maximise the working capital potential of an SCF programme, it should be part of an integrated Procure to Pay (P2P) strategy and approach. It is applicable to any industry having significant supplier spend and has been successfully implemented by many major global MNCs.”

PwC: A diagram of a Procure to Pay (P2P) strategy as part of SCF

How working capital monetization works (PwC).

Asset managers ⏤ like banks ⏤ are in the supply-side of this market. In most cases, you aren’t involved with paying suppliers within a supply chain.

Asset managers simply supply funding or are part of a consortium of funding providers. Asset managers can also be participants in trade finance and working capital, especially when banks want to distribute their programs.

When funding assets, asset managers need a way of managing this within the context of your firm’s investment and risk strategies.

You also need a way of monitoring the performance of any working capital monetization investments. Let’s look at how asset managers can either get into this market, or improve and streamline their current working capital monetization strategies.

How Asset Managers Can Monetize Trade Finance

The most effective way to get into this market is to use trade finance software solutions to facilitate the entire end-to-end process.

It might be tempting to ask: Would it be better to have in-house software custom-built for this purpose?

In our experience, it’s not worth the time or capital investment.

If you want to upgrade how you’re currently managing working capital investments, or start from scratch, it’s quicker and easier to work with a software provider who can have you up-and-running quickly, and who can manage everything for your firm.

LiquidX’s suite of trade finance solutions can handle everything, with a smooth-running turnkey front-, middle- and back-office operation that manages the entire origination to reconciliation lifecycle.

Our software is also ideal for asset managers who want to monitor trade finance investments within your larger portfolio. This way, you can track invoices and data involved in funding this asset class and when to expect a return on the capital invested.

Here’s what you can benefit from when you partner with LiquidX:

- Trade finance software that can take in any invoice format (e.g., XLSX, PDF, etc.), and use that as workable data downstream across the trade lifecycle.

- Automatically digitizes assets in the front office (Trade).

- Manages portfolio risk with TradeHub.

- Make significant back office savings (TradeOps); up to 50% savings compared to in-house back office software.

- Can handle reconciliation challenges for asset managers (InMatch module).

- Includes the advantages of a deep partnership with Broadridge (NYSE: BR), a trusted global fintech leader. Broadridge is LiquidX’s largest committed investor and strategic operational services provider for payment processing, account reconciliation, and global operational scalability.

Everything we offer meets the needs of asset managers in the working capital monetization market. Our software handles tens of billions of dollars worth of transactions every year, and we’re working with some of the world’s largest asset management firms and banks.

As BNY says: “Select a vendor that can provide technology solutions to match the company’s business model and be integrated with existing platforms.”

“Integration with existing corporate platforms is critical because if the data is insufficiently rich, treasurers may not have the comprehensive picture of working capital needed across enterprise resource planning (ERP) systems, treasury management systems, and invoice generation.”

Integration is crucial, otherwise, you won’t have a clear picture of the flow of funds, risk factors, and reconciliation timescales.

Key Takeaways: The Trade Finance Opportunity for Asset Managers

Economic turbulence has always created opportunities. Trade finance, in all its forms, represents an opportunity for asset managers who aren’t in this market yet.

At the same time, for asset managers already in this market, it’s worth looking at how you manage trade finance investments to decide if your current processes need an upgrade.

If managing trade finance is taking too much time, unclear, often missing details and data, then your current processes aren’t fit-for-purpose. Financial organizations that fail to update and adapt always lose out to those that have already taken that next technological step forward.

Between LiquidX’s trade finance solutions and our partnership with Broadridge (NYSE: BR), a trusted global fintech leader, we can help any asset management firm get into the trade finance market.

💡Here’s another great reason to work with us! In December 2024, Global Business & Finance Magazine awarded LiquidX with three awards for the second year in a row:

- Best Digital Solutions For Global Trade United States 2025

- Best Technology Vendor Of The Year United States 2025

- Best Fintech For Trade United States 2025

Asset Managers: To request a demo of our trade finance distribution solutions, click here.